See what I did there with the title…. Pretty clever huh :)

But in all seriousness, the above is soon approaching us. No doubt you have heard the popular phrase ‘What goes up must come down!’. Well this applies to real estate absolutely. But the reverse also applies - ‘what goes down, must come up!’. This ladies and gentleman, brings us to our current market climate.

We have hit the bottom when it comes to price drops, again we are talking about actual market value, not your neighbour listed $300,000 above market value. We are in fact now at the point the market value is rising slightly. This is a lot easier to absorb, in theory, on a million dollar property than it is an entry level home for first time home buyers/investors.

With the last few months seeing a steady increase of 0.7% across the board, this is putting pressure back on those looking in that price range. It’s not uncommon for first time home buyers to have a budget of $600,000 - $650,000. If you are playing in that range right now, these slight market increases are piling up and building against you! Take a $625,000 home sold in October 2019, that same home now is worth $638,125. In 3 months time, assuming the same slight market increases occur, $651,250.

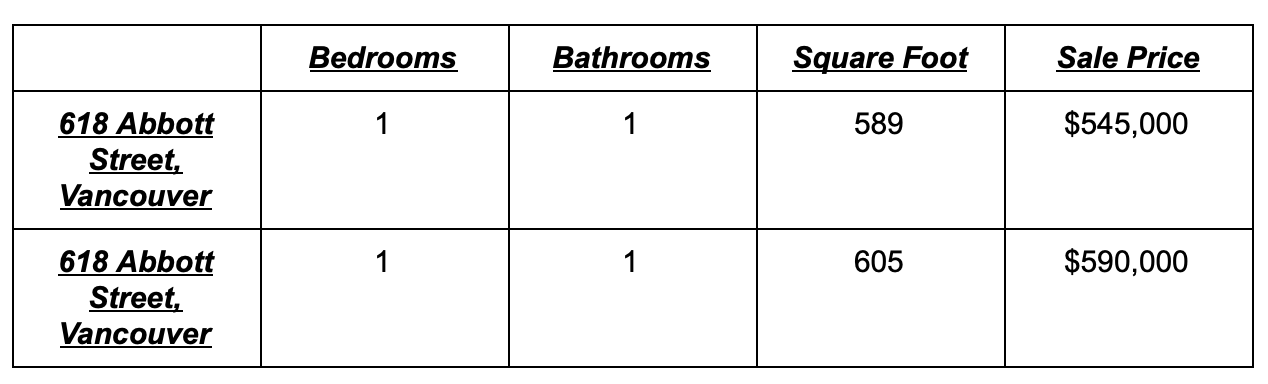

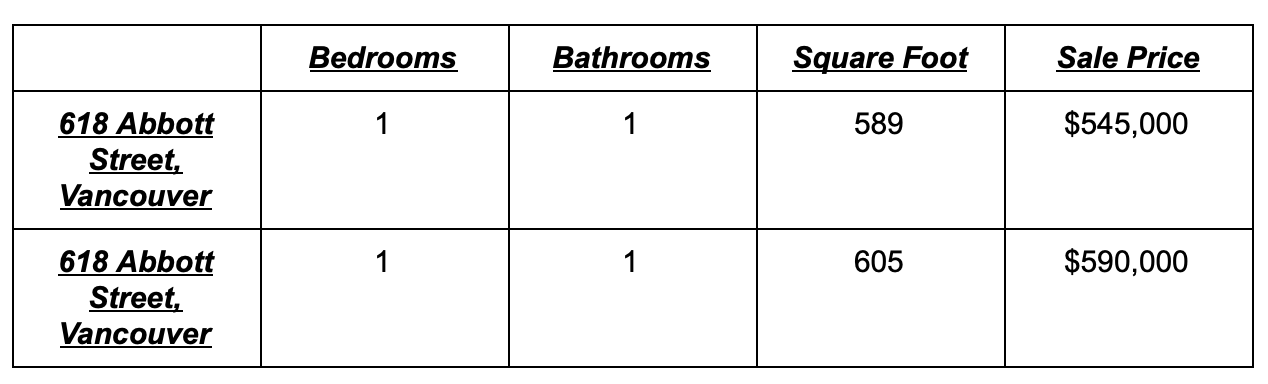

You see how a matter of a few months delay can outright take something out of your reach? Especially if you are pre-approved and cautious of risking that, let alone applying for a higher sum of approval. The above example is just a market average example too, the baseline of the market if you will. More drastic changes have taken place such as the following condo examples:

In the above example, they are practically identical products. In fact they are next to each other in the building too, we are just not allowed to put the unit address. One did not have an additional den, parking space or view. That’s a $45,000 jump! On top of this, one of the most recent sales in the building for a similar product was just $665,000.This type of jump is not uncommon in Vancouver right now either. That new figure now sets a new benchmark pricing for that product!

Admittedly the above example is a post 2000’s building, concrete and amenities. However, how happy and excited are you going to be knowing you could afford this before and now have to look at much older apartments, little, to possibly no amenities, and potentially not having in-suite laundry etc. That’s a vast change in day to day quality of life and enjoyment.

These slight increases build up and are much more noticeable in the entry level markets, now unfortunately pricing people out of where they envisioned they could get to. If this is ringing true with you, waiting till Spring could be deadly for your chances. Sure, more property comes to market, but what good is it if all that property is out of your price range. NOW is the key time, and possibly your last chance, to move forward. We mentioned last week about not getting caught ‘studying the market’ and preparing your move. Delay is quite literally a gamble in the current market climate. On top of this, the market is still showing signs of rising.

Don’t let yourself be one of the many who end up rueing their chances!

Until next week,

But in all seriousness, the above is soon approaching us. No doubt you have heard the popular phrase ‘What goes up must come down!’. Well this applies to real estate absolutely. But the reverse also applies - ‘what goes down, must come up!’. This ladies and gentleman, brings us to our current market climate.

We have hit the bottom when it comes to price drops, again we are talking about actual market value, not your neighbour listed $300,000 above market value. We are in fact now at the point the market value is rising slightly. This is a lot easier to absorb, in theory, on a million dollar property than it is an entry level home for first time home buyers/investors.

With the last few months seeing a steady increase of 0.7% across the board, this is putting pressure back on those looking in that price range. It’s not uncommon for first time home buyers to have a budget of $600,000 - $650,000. If you are playing in that range right now, these slight market increases are piling up and building against you! Take a $625,000 home sold in October 2019, that same home now is worth $638,125. In 3 months time, assuming the same slight market increases occur, $651,250.

You see how a matter of a few months delay can outright take something out of your reach? Especially if you are pre-approved and cautious of risking that, let alone applying for a higher sum of approval. The above example is just a market average example too, the baseline of the market if you will. More drastic changes have taken place such as the following condo examples:

In the above example, they are practically identical products. In fact they are next to each other in the building too, we are just not allowed to put the unit address. One did not have an additional den, parking space or view. That’s a $45,000 jump! On top of this, one of the most recent sales in the building for a similar product was just $665,000.This type of jump is not uncommon in Vancouver right now either. That new figure now sets a new benchmark pricing for that product!

Admittedly the above example is a post 2000’s building, concrete and amenities. However, how happy and excited are you going to be knowing you could afford this before and now have to look at much older apartments, little, to possibly no amenities, and potentially not having in-suite laundry etc. That’s a vast change in day to day quality of life and enjoyment.

These slight increases build up and are much more noticeable in the entry level markets, now unfortunately pricing people out of where they envisioned they could get to. If this is ringing true with you, waiting till Spring could be deadly for your chances. Sure, more property comes to market, but what good is it if all that property is out of your price range. NOW is the key time, and possibly your last chance, to move forward. We mentioned last week about not getting caught ‘studying the market’ and preparing your move. Delay is quite literally a gamble in the current market climate. On top of this, the market is still showing signs of rising.

Don’t let yourself be one of the many who end up rueing their chances!

Until next week,

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com