WHAT DOES 2023 LOOK LIKE IN REAL ESTATE?

As we start closing out the year and coming to a slower part of the yearly cycle (Christmas, New Year etc.) We start to turn our heads to what the upcoming year may look like, especially with such a frantic year behind us… Thank God.

To round out the year I fully expect another hike from the Bank of Canada in December. To me that’s going to be another .50bps hike, taking the overnight lending rate (OLR) to 4.25%, and Prime rate to 5.99 - 6.49%. Even though this is high, don’t be too quick to assume things are just going to get worse. No, this is not a Realtor optimism blog for the sake of it, I promise.

The main changes since the peak have not really been taken advantage of from buyers yet. Think about it. Much less competition has been met with not enough supply. Price reductions since the peak have been nullified due to Interest rate hikes. These problems are not mutually exclusive to each other either. Take a look at the example below…

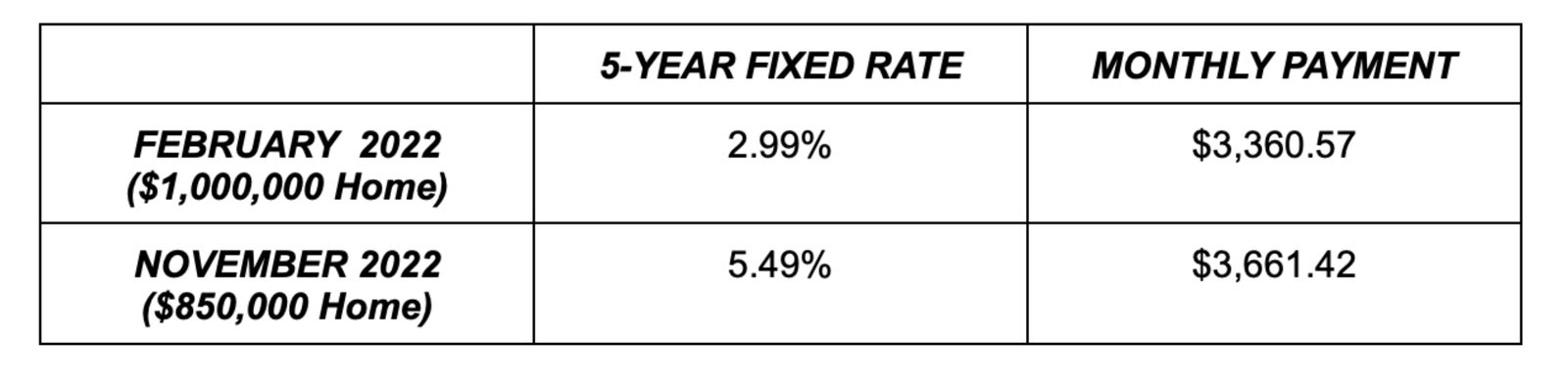

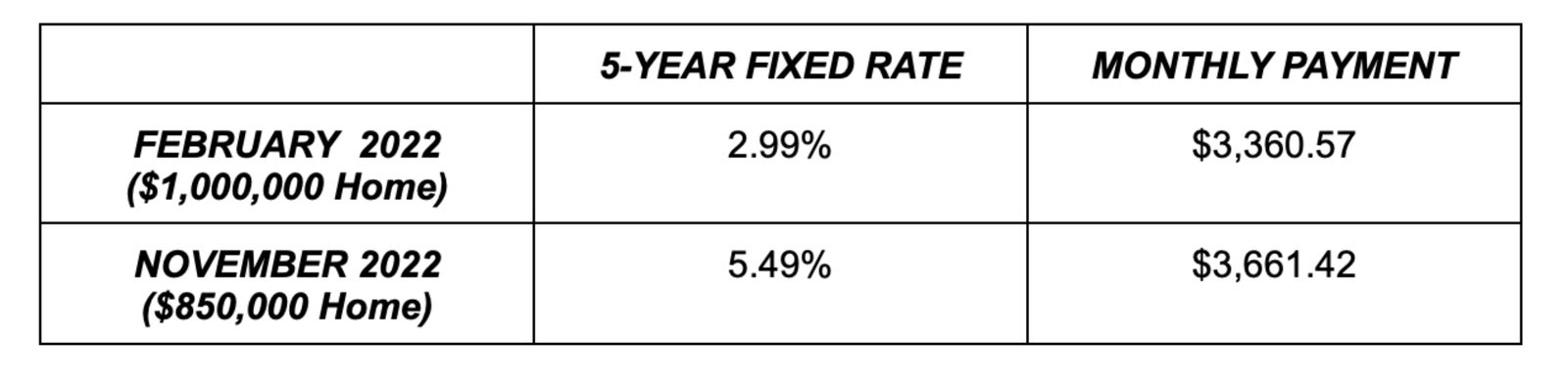

Assuming a $200,000 down payment, over a 30-Year amortisation period. In February the subject home cost $1,000,000. Since then, assume it’s gone down 15%, and is now worth $850,000, but you are still putting in the same down payment ($200,000). This is how your monthly mortgage payment would look at the higher value vs lower value

That’s right, for the same home, although it’s gone down in price you are still paying more due to the higher interest rates. So yes, technically the market has come down 15%, but the end user pricing is not realised at this point. In fact, it’s more.

Even when looking at supply, it’s not as busy out there right now, and supply has steadily increased since peak lows. However, not at high enough amounts to make a difference. If you’re looking right now it’s highly likely you’ve still been facing competition purely as there is little inventory out there. Erasing the benefit of “the market has slowed 40%”.

So with this being said, why does 2023 potentially look more optimistic?

Interest rates have been having a huge effect on buyers AND sellers. Not just from a “What can I afford?” standpoint. It’s the unknown that worries them. Once interest rates settle, it breeds confidence on both sides, meaning more sellers come to market as you take away (or even heavily reduce) the ‘unknown’ part of that equation. Same thing for more buyers entering the market.

So the real factor in this will be Supply. Can supply keep creeping up enough to outpace demand. The balancing of interest rates will help for sure, as some look to the end of their terms they will likely opt to sell, and hopefully we will finally see interest rates reduce in Q4 of next year (key word, hopefully)

You’ll also see a “double bubble” effect when we inevitably see interest rates decrease. Right now the higher rates swallow up, and more, any market price decreases. I believe the market has further to adjust downwards, so couple this with inevitably reducing interest rates, makes for savings on both fronts. Don’t forget a lot of sellers don’t come to market in the fear of “What would I move in to?”. Those who purchased a while ago are still going to be up on value and have the opportunity to shop during a less volatile market, while still being up on their initial investment.

We are starting to see supply chain inflation move in the right direction here in Canada too, this means the Bank of Canada's monetary policy will start to see a genuine decrease in domestic inflation. This makes the economy look more optimistically towards the future, which inevitably bolsters the Housing market.

HOWEVER - The phrase I’m going to opt for here is “The new normal”. Interest rates will not come back down to 1.5% and housing prices are not going to skyrocket 40%. I actually think you’ll end the year down on a year over year basis for most properties. So this rally will push us into a more balanced territory. It’s highly likely we hit that recession at the beginning of 2023 given GDP expectations and increasing Unemployment. At this point it seems inevitable, so the faster we hit it and start working on our balancing act the better. Just make sure your expectations are aligned with the new reality, and not blue moon markets.

Have your own thoughts on what will happen in the market? Feel free to leave a comment and let me know what you think!

As we start closing out the year and coming to a slower part of the yearly cycle (Christmas, New Year etc.) We start to turn our heads to what the upcoming year may look like, especially with such a frantic year behind us… Thank God.

To round out the year I fully expect another hike from the Bank of Canada in December. To me that’s going to be another .50bps hike, taking the overnight lending rate (OLR) to 4.25%, and Prime rate to 5.99 - 6.49%. Even though this is high, don’t be too quick to assume things are just going to get worse. No, this is not a Realtor optimism blog for the sake of it, I promise.

The main changes since the peak have not really been taken advantage of from buyers yet. Think about it. Much less competition has been met with not enough supply. Price reductions since the peak have been nullified due to Interest rate hikes. These problems are not mutually exclusive to each other either. Take a look at the example below…

Assuming a $200,000 down payment, over a 30-Year amortisation period. In February the subject home cost $1,000,000. Since then, assume it’s gone down 15%, and is now worth $850,000, but you are still putting in the same down payment ($200,000). This is how your monthly mortgage payment would look at the higher value vs lower value

That’s right, for the same home, although it’s gone down in price you are still paying more due to the higher interest rates. So yes, technically the market has come down 15%, but the end user pricing is not realised at this point. In fact, it’s more.

Even when looking at supply, it’s not as busy out there right now, and supply has steadily increased since peak lows. However, not at high enough amounts to make a difference. If you’re looking right now it’s highly likely you’ve still been facing competition purely as there is little inventory out there. Erasing the benefit of “the market has slowed 40%”.

So with this being said, why does 2023 potentially look more optimistic?

Interest rates have been having a huge effect on buyers AND sellers. Not just from a “What can I afford?” standpoint. It’s the unknown that worries them. Once interest rates settle, it breeds confidence on both sides, meaning more sellers come to market as you take away (or even heavily reduce) the ‘unknown’ part of that equation. Same thing for more buyers entering the market.

So the real factor in this will be Supply. Can supply keep creeping up enough to outpace demand. The balancing of interest rates will help for sure, as some look to the end of their terms they will likely opt to sell, and hopefully we will finally see interest rates reduce in Q4 of next year (key word, hopefully)

You’ll also see a “double bubble” effect when we inevitably see interest rates decrease. Right now the higher rates swallow up, and more, any market price decreases. I believe the market has further to adjust downwards, so couple this with inevitably reducing interest rates, makes for savings on both fronts. Don’t forget a lot of sellers don’t come to market in the fear of “What would I move in to?”. Those who purchased a while ago are still going to be up on value and have the opportunity to shop during a less volatile market, while still being up on their initial investment.

We are starting to see supply chain inflation move in the right direction here in Canada too, this means the Bank of Canada's monetary policy will start to see a genuine decrease in domestic inflation. This makes the economy look more optimistically towards the future, which inevitably bolsters the Housing market.

HOWEVER - The phrase I’m going to opt for here is “The new normal”. Interest rates will not come back down to 1.5% and housing prices are not going to skyrocket 40%. I actually think you’ll end the year down on a year over year basis for most properties. So this rally will push us into a more balanced territory. It’s highly likely we hit that recession at the beginning of 2023 given GDP expectations and increasing Unemployment. At this point it seems inevitable, so the faster we hit it and start working on our balancing act the better. Just make sure your expectations are aligned with the new reality, and not blue moon markets.

Have your own thoughts on what will happen in the market? Feel free to leave a comment and let me know what you think!