Aspiring homebuyers often face a daunting task in saving up for a down payment. In Canada, where housing prices have skyrocketed in recent years, it can take the average Vancouverite up to 20 years to save up a 15% to 20% deposit on a home. However, the government has put in place several programs to help first-time homebuyers reach their goals faster.

One such program is the First-Time Home Buyers Tax Credit (HBTC). If you are purchasing your first home and have not owned a home in the prior four years, you can enter $10,000 on Line 31270 of your Schedule 1 Federal Tax Return to save up to $1,500 in taxes. This credit can be split between spouses or common-law partners but cannot exceed $10,000.

Additionally only 35% of Canadians have set up a TFSA account, and just 10% of account holders max out their contributions, according to Statistics Canada. It's important to note that the TFSA is not a savings account but rather an investment account that allows for tax-free capital growth and withdrawals with a really misleading name.

Do you think saving 20% of your income will be able to continue to keep pace with the market over your average 20 year savings timeline? Very very difficult to achieve that. So wy are you not using your tax sheltered investment accounts to assist you? Dont gamble, invest your money through these strategically placed accounts and work with your own leverage as you save. Look at the numbers on the TSX Index over the past 50 years:

TSX index 50 years – 8 bull markets / 6 bear markets (chart: ’79 – ’22)

No it's not even enough to keep up to real estate over the past 20 years. But at least you would have been progressing your savings in the right direction. Now, let's look at cash. How did it perform against CPI inflation:

Cash: CPI inflation

If you held cash you now have two factors working against you, the rising prices of the asset you want to buy & the loss of buying power of the currency you are trying to save to purchase the asset... This is a horrible strategy as you can see, you are loosing from both ends.

As I am not a financial planner you need to contact yours and discuss what 10 - 20 year strategies they recommends you invest your deposit money into. You are doing yourself a disservice by holding your deposit in cash for this long period of time. Contact a planner or do your own deep research matched with your comfort level & risk tolerance and start getting that cash working for you. Also remember if you are close to purchasing and close to your goal amount of down payment it may make sense to now pull all of the money into cash or a GIC of sorts in the SHORT TERM to de-risk the money from any short term market swings to have it ready....

Another option for first-time homebuyers is the Home Buyers Plan (HBP). This program allows you to withdraw up to $35,000 ($70,000 for couples) from your Registered Retirement Savings Plan (RRSP) to use as a down payment on your first home. You have 15 years to repay the amount, starting in the third year at $2,692.30 per year. Contributions to your RRSP are tax-deductible against your personal taxable income.

In addition to the HBP, you may also want to consider contributing to a Tax-Free Savings Account (TFSA). This account allows you to contribute up to $6,500 in 2023, with a current maximum lifetime contribution of $88,000. The contributions are made with after-tax dollars, but capital growth and withdrawals are tax-free. The contribution room accumulates and rolls forward, so you can continue to contribute to the account and build up your savings over time.

The government is also set to introduce a new program called the First Home Savings Account (FHSA) in April or May 2023. This program allows parents to contribute up to $8,000 per year ($40,000 lifetime contribution) to help their children save for a down payment on their first home. Contributions are tax-deductible, and capital growth and withdrawals from the account for the purpose of buying a first home are tax-free. Once the account is opened, you have 15 years to use the funds to purchase your first home. It's important to note that you should fill up your FHSA limit first and then your TFSA limit on your way to homeownership.

While these government programs are helpful, it's still important to save as much as possible on your own. The median income in Vancouver is $73,000, and a 20% down payment on a $1.4 million house would be $280,000. This means it will take a long time to save up for a down payment, especially if you're only able to save a small portion of your income each year.

Most people save for their down payment in their RRSPs, withdrawing the money when they are ready to buy. However, the maximum you can withdraw is $35,000, which is only a fraction of what's needed for a down payment on a home in Vancouver. So where are you growing the rest of your down payment money? From my experience I find that most people hold the difference of their down payments in cash. This Is not smart.In my research only 33% of Canadians contributed to their RRSP accounts in 2022, according to the Canada Revenue Agency.

Additionally only 35% of Canadians have set up a TFSA account, and just 10% of account holders max out their contributions, according to Statistics Canada. It's important to note that the TFSA is not a savings account but rather an investment account that allows for tax-free capital growth and withdrawals with a really misleading name.

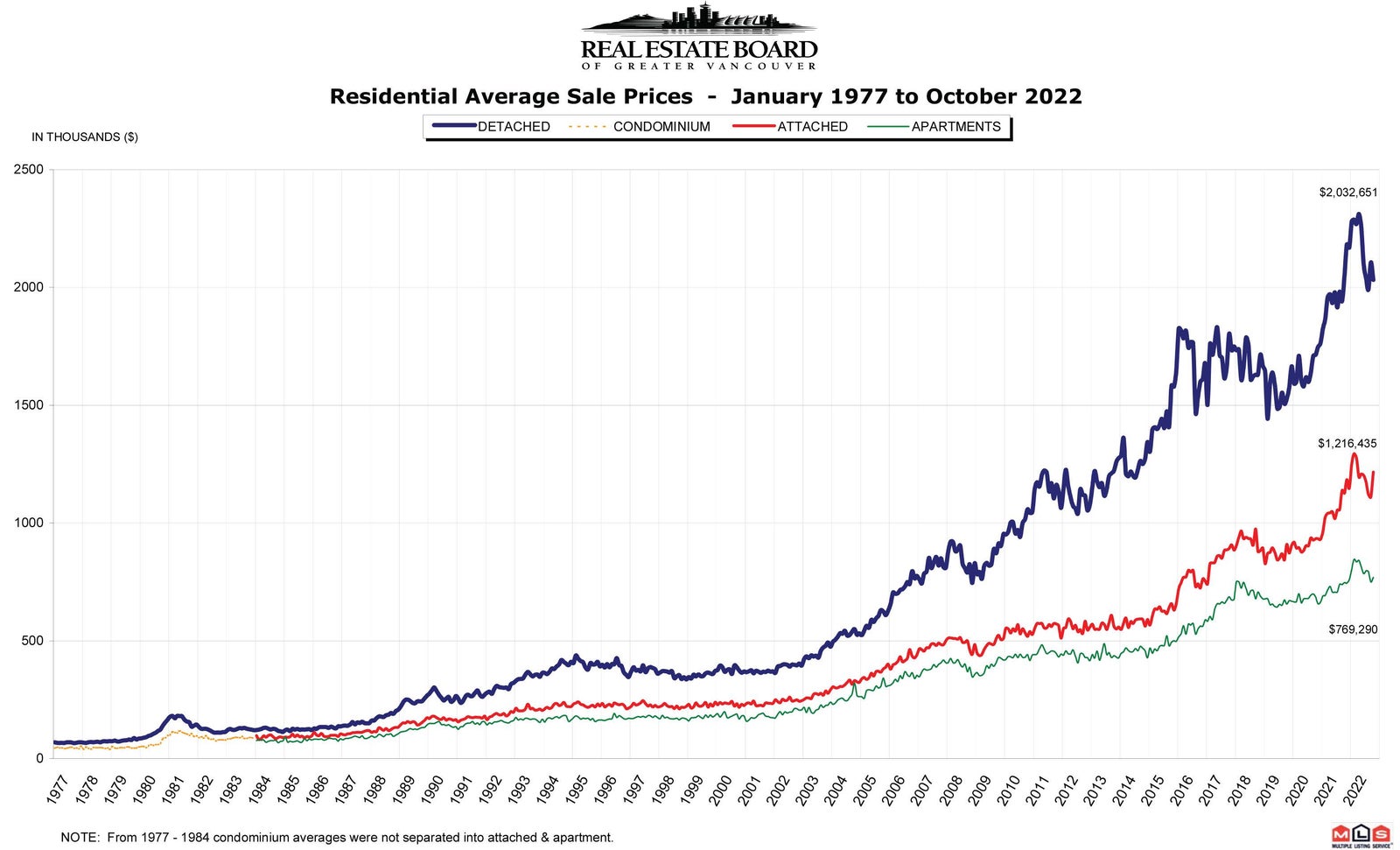

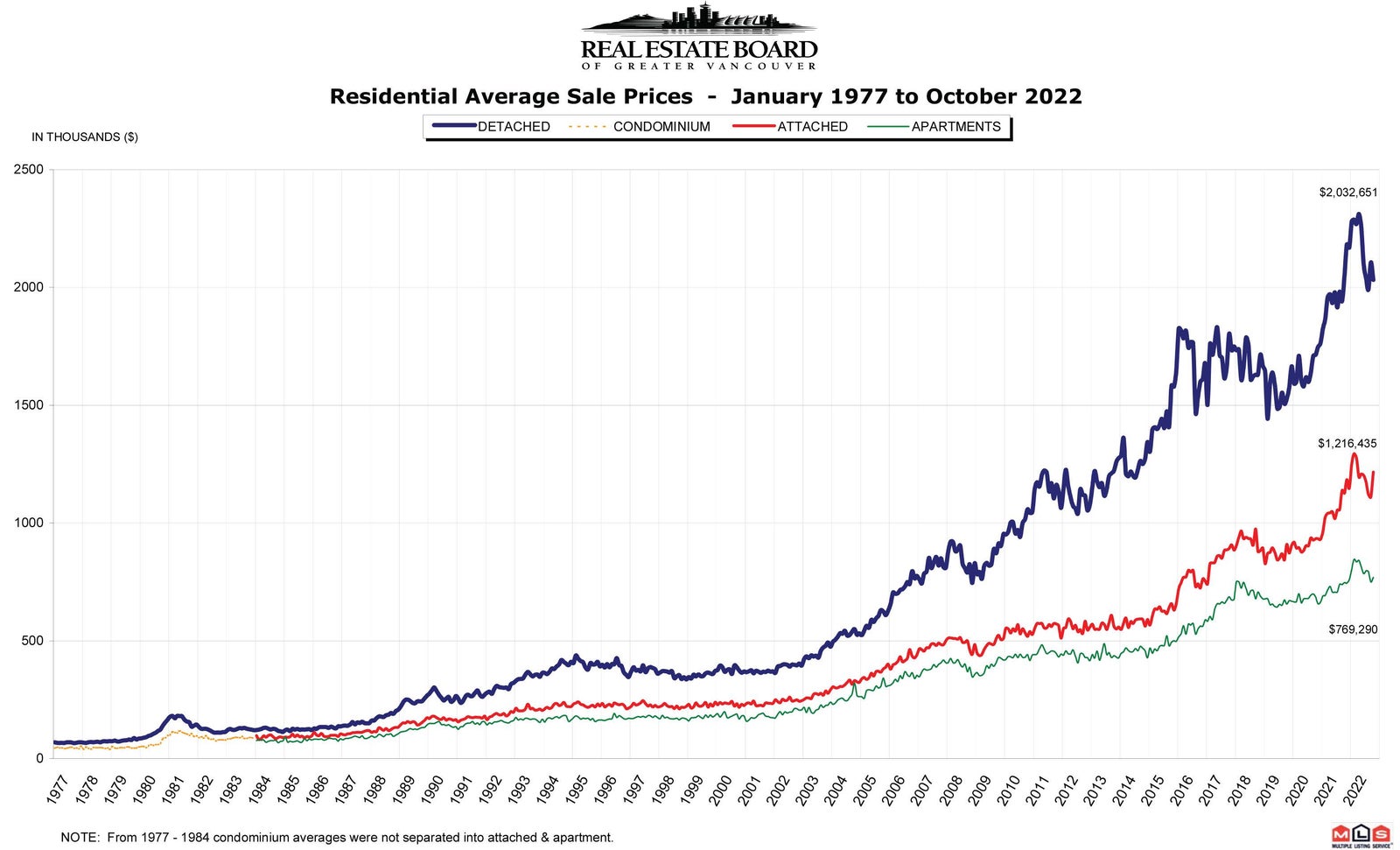

It's also worth noting that holding cash can work against you in the long run. The Vancouver real estate market has seen four bull markets and three bear markets over the past 50 years. Look at these notable Housing sales price increases:

Vancouver Real Estate Market 50 years – 4 bull markets / 3 bear markets (chart: ’77 – ’22)

Vancouver Real Estate Market 50 years – 4 bull markets / 3 bear markets (chart: ’77 – ’22)

Average Houses sales $:

2003 – 2010 : $500k - $1m

2010 – 2015 : $1m - $1.5m

2015 – 2021 : $1.5m - $2m

Total gain: +$1.5M (300%)

Do you think saving 20% of your income will be able to continue to keep pace with the market over your average 20 year savings timeline? Very very difficult to achieve that. So wy are you not using your tax sheltered investment accounts to assist you? Dont gamble, invest your money through these strategically placed accounts and work with your own leverage as you save. Look at the numbers on the TSX Index over the past 50 years:

TSX index 50 years – 8 bull markets / 6 bear markets (chart: ’79 – ’22)

TSX up 1,098% in 45yrs

2003 – 2010 : +77.5%

2010 – 2015 : +24.57%

2015 – 2021 : +19.14%

Total gain: +121.21%

No it's not even enough to keep up to real estate over the past 20 years. But at least you would have been progressing your savings in the right direction. Now, let's look at cash. How did it perform against CPI inflation:

Cash: CPI inflation

2003 – 2010 : 20.51%

2010 – 2015 : 12.37%

2015 – 2021 : 7.60%

Total loss of buying power: 40.48%

If you held cash you now have two factors working against you, the rising prices of the asset you want to buy & the loss of buying power of the currency you are trying to save to purchase the asset... This is a horrible strategy as you can see, you are loosing from both ends.

As I am not a financial planner you need to contact yours and discuss what 10 - 20 year strategies they recommends you invest your deposit money into. You are doing yourself a disservice by holding your deposit in cash for this long period of time. Contact a planner or do your own deep research matched with your comfort level & risk tolerance and start getting that cash working for you. Also remember if you are close to purchasing and close to your goal amount of down payment it may make sense to now pull all of the money into cash or a GIC of sorts in the SHORT TERM to de-risk the money from any short term market swings to have it ready....

In short, As the assets rise and the money devalues you need to be smart about deposit money placement.Speak to your planner about what would work best for you and get your self on the right track to hopefully shorten the average time to get your down payment set aside in full and ready for a purchase.

Thank you for your attention and see you next week!