There are 2 aspects to this whole thing.

- - DCL - - EXAMPLES D.C.L’s / DCC’s (Developer Cost Levies / Developer cost charges) – money for infrastructure rated to growth. charged $/SqFt basis for residential development. On top of any municipal charged for developments. Already doubled this year in 2023.

Residential DCL:Vancouver – $32/sqft of new Highrise housing May not seem like much, but that’s not all!

Lets take things back a few years first…

When you make money easy to get, people take it.

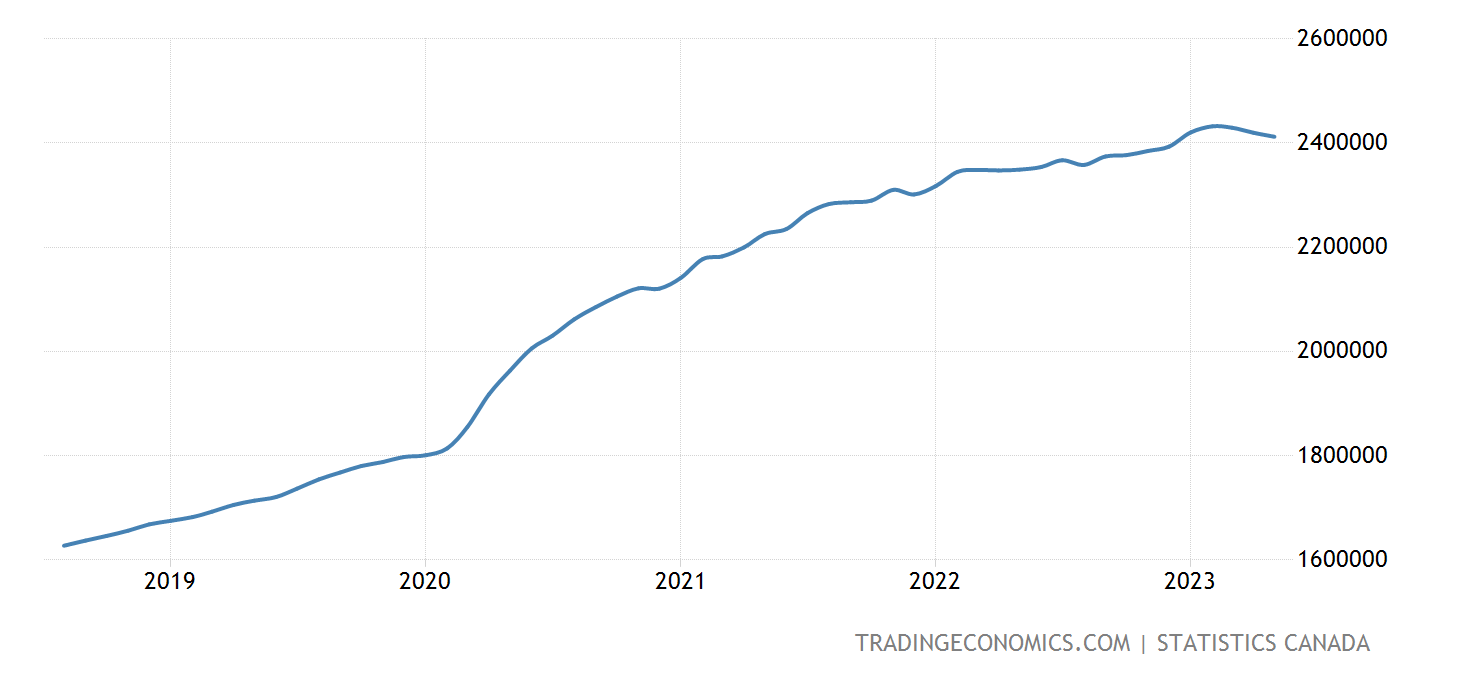

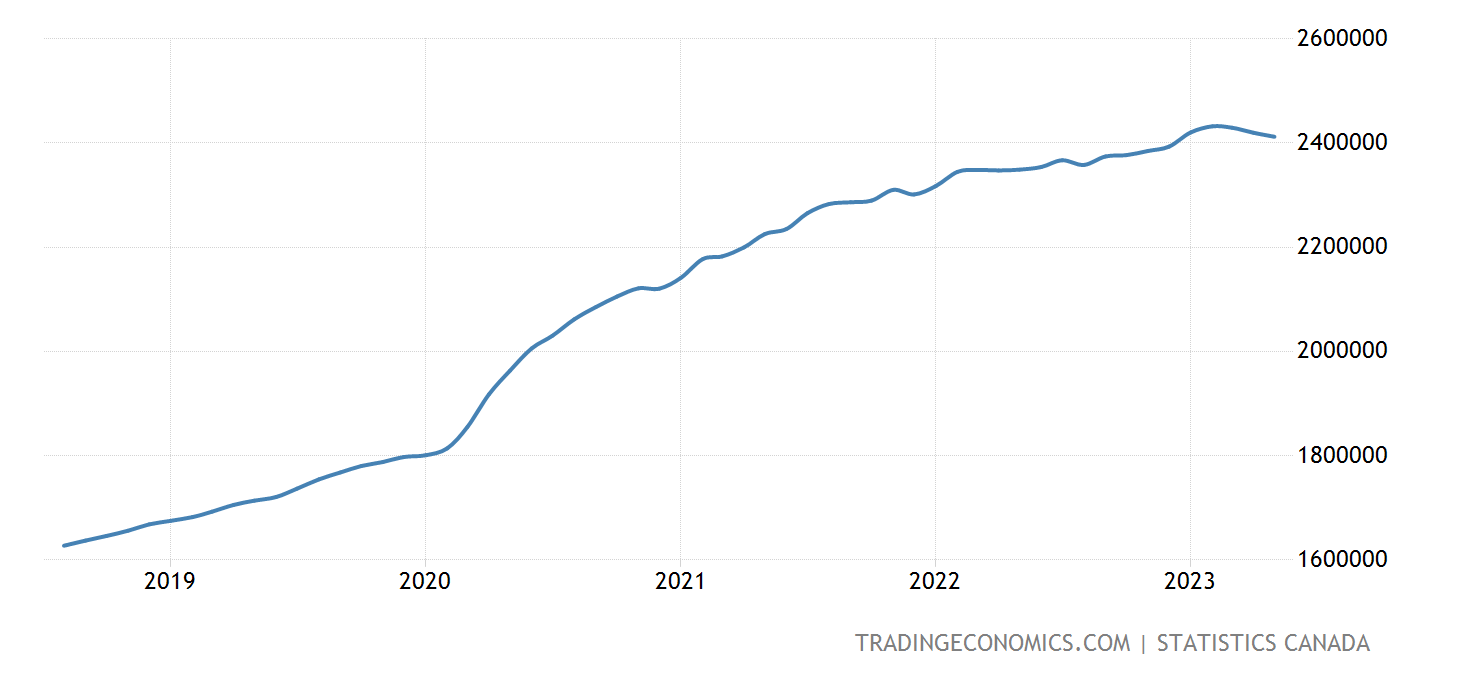

SHOW CHART:

Inflation – total M2 (cash/bank accounts/anything you can spend) money supply has increased 33% from 2020 – now. 1.8T – 2.4T (600 billion) in circulation.What does that mean, simply as money enters the system it becomes less scares, in turn diluting its own value, in turn making the amount of money needed to buy things inflate. You feel this with prices going up of the things you buy. Specifically things that people look as safe hedges against inflation… houses & stocks

Here is How the Government makes real estate more expensive:

Personal level: what us normal citizens see….. the government touches us in many ways

GST (5%) on new product

PTT (1% on 1st $200k / 2% on balance) all purchases.

- Vacancy Tax

- Speculation Tax

- Foreign Buyers Tax

IT GOES MUCH DEEPER THAN THAT

Developer level:

D.C.L’s / DCC’s (Developer Cost Levies / Developer cost charges) – money for infrastructure related to growth. charged $/SqFt basis for residential development. On top of any municipal charged for developments.

C.A.C’s (Community Amenity Contribution – cash payments / donation of park space / childcare spaces / recreational facilities / public libraries / art & cultural spaces / even social & affordable housing portions of buildings or entirely new buildings & transportation infrastructure

*****FUNDAMENTAL FACT: “If fewer units can sell at prices that cover increased costs, then fewer units will be built”*****

- - DCL - - EXAMPLES D.C.L’s / DCC’s (Developer Cost Levies / Developer cost charges) – money for infrastructure rated to growth. charged $/SqFt basis for residential development. On top of any municipal charged for developments. Already doubled this year in 2023.

- Residential / commercial / industrial have their own specific levies.

Water & sewage – most expensive infrastructure 82.5% of sewage related costs - developers cover

50% of water related costs - developers cover 99% of system expansion covered by developers, NOT water sales / liquid waste levies / sewage etc to actual home owners….

Residential DCL:Vancouver – $32/sqft of new Highrise housing May not seem like much, but that’s not all!

Ken Sim: Vancouver Mayor**

City of Vancouver now delaying the increase of the 2023 DCL’s as they had planned to now add a 20.8% RESIDENTIAL – 28.3% non-residential increase in September 2024.

- Needed to pay 3rd party consultants to tell them that “current economic conditions are challenging.” – reason for delaying

- Not decreasing the tax, just postponing the raising of the tax.

Recent RBC economics report – Construction costs in Canada have increased 51% since 2020.

- Concrete up 55% since 2020

- Steel up 53% since 2020

- Labour costs +9.4% since 2022 – with labour shortage

- + BIV

- Higher fuel costs – as of April 2023 the cost of tax alone imposed on gasoline will cost BC drivers a total of 77.4 cents per liter in the lower mainland.

2 provincial carbon taxes (31 cents/L) – highest in canada

1 provincial excise tax of (8.5 cents/L) ?? – fixed federal tax in disguise

Translink tax (18.5 cents/L)

Federal government (19.4 cents/L)

- Home heating carbon tax (natural gas) – average $227/yr/home

** are people driving less because they want to save environment? no

Have to wonder ** taxing mandatory spending outlets it really screws people

EXAMPLE:: - Burgess, Cawley, Sullivan & Associates – RE appraisers/tax consultants

2018 Cambie Corridor 800SqFt unit (AV $960K), 3yr wait time for permits & 2 years of construction:

Municipal/Regional costs

- Residential property Tax

- Vacant Home Tax

- Community Amenity Contribution

- Metro Vancouver Sewage Development Cost Charge

- Development Cost Levy

- Translink Development Cost Charge

- Community Public Art

- Building Permit Fee

- Development Permit Fee & Zoning charge

Provincial costs

- Property Transfer Tax X2 ( 1 X 2% & 1 x 3%)

- Speculation TaxFederal costs

- 5% GST

TOTAL:

$314.65/Saleable SqFt

$251,721.00 (26%)

-500SqFt Studio ($157,326 tax/fee)

700SqFt 1 Bed ($220,256 tax/fee)

900SqFt 2 Bed ($283,186 tax/fee)

1,200SqFt 3 Bed ($377,582 tax/fee)

EXAMPLE – R.E fees on that 1st example at $960k purchase price = $28,500 (7/2.5)

- - CAC’s - - EXAMPLES

C.A.C’s (Community Amenity Contribution – cash payments / donation of park space / childcare spaces / recreational facilities / public libraries / art & cultural spaces / even social & affordable housing portions of buildings or entirely new buildings & transportation infrastructure

EXAMPLES:

Anthem Properties (W Georgia & Bidwell / old chevron) – chevron site sold for $72m in 2017

- 127 units / 33 stories

- $26.1m C.A.C’s ($15.66m cash up front (60% up front before re-zoning approved then following 40% paid before 1st building permit issues - city policy))

1640-1650 Alberni St

- Mixed use 43 stories / 198 luxury units with 66 rental units + 3 levels of office

– designed by the architect of Burj Khalifa - $33 million in CAC’s.

** City trying to keep coal harbour full of luxury to keep the CAC’s high in order to replace West End Community Centre & Library & replace Vancouver Aquatic centre. **

in 2021 City approved 75 new rezoning applications:

- $300 million in CAC’s

- Cash / 144 social housing units / 123 kid childcare facilities / 14,500SqFt non-profit office space / 6000SqFt of youth centres / 9 artist live/work studios + cultural amenity spaces.

** 21 acre heather lands - $13m + in-kind benefits CAC’s

**40story (128 unit) west end development - $37m cash CAC

COMBINATION – DCL & CAC costs:

** Canadian Home Builders Association (CHBA) – City of Vancouver has the highest municipal fees in exchange for approval for new high-rise development in the country.

- $157/SqFt (up 25% since 2020) in total charges levied by city of Vancouver with total D.C.L’s & C.A.C’s.

- Surrey - $61 SqFt (up 54% since 2020)

- Burnaby $24 SqFt (up 37% since 2020)

- Vancouver (low rise) $28 SqFt (up 29% since 2020)

- Surrey (low rise) $38 SqFt (up 62% since 2020)

- Burnaby (low rise) $13 (up 43% since 2020) Vancouver single & duplex family fees up 30% in 2022

Conclusion

Vote wisely & just go work harder and make more money…. Because really its out of your hands….